Most people that have IRS problems haven’t filed in a few years. It’s a common problem. You are not alone. Don’t be embarrassed. Nearly 10 million people have delinquent tax returns. In all my years of practicing before the IRS, I’ve seen people that had a rough patch in their life that kept them from filing and paying their taxes. IRS problems happen to good people. Someone gets sick and can’t work, and someone loses their job. It’s terrible. There’s no money to pay the taxes one year, so they don’t file, and the person is afraid to file after that. They don’t want to get caught, and they certainly don’t want to end up in jail. But worse than not paying your taxes is not filing your return—it’s against the law.

You may be asking, “Is there anything I can do to get my life back”? Yes, there is! You can get your life back. First, you have to decide that you want your life back. Then, you have to decide that you aren’t going to take this anymore and want to fix it. Once you decide that you want help and no longer want to live in fear or hide from those dreaded IRS notices, phone calls, and visits, you will have taken the biggest step in getting your life back on track. Don’t let the IRS bully you into hiding under a rock, in the closet, or under your blankets. There are many options and ways to get your life back—and even better yet, there’s a way to protect your savings and your paycheck, a way for you to keep your car!

Even if you don’t have the money to pay, at least file your taxes. There are two penalties. One is “Failure to File Penalty,” and the other is “Failure to Pay Penalty.” You can avoid one of these severe penalties by filing your taxes. There are all types of programs that are available from the IRS to settle your tax debt. The most important thing is that you want to be compliant with the tax laws.

The laws have changed over the years—there are laws to protect taxpayers nowadays. Years ago you were just at the mercy of the IRS. But now you have a chance to get your life back. You could opt to represent yourself before the IRS. There is the offer-in-compromise program. Some people do go that route. But representing yourself before the IRS is like going to court without a lawyer. I wouldn’t recommend that. Or, you can hire someone that knows all the ins and outs and navigates the IRS maze on a daily basis. You can hire someone who knows how to protect you and your rights. Once you take that first big step and decide you are done with sleepless nights, you need to make the second biggest decision—Hire a competent professional who cares about you and is an expert taking on the IRS. They can help find your old tax records, including your W-2’s, 1099’s and 1098’s that were previously reported to the IRS.

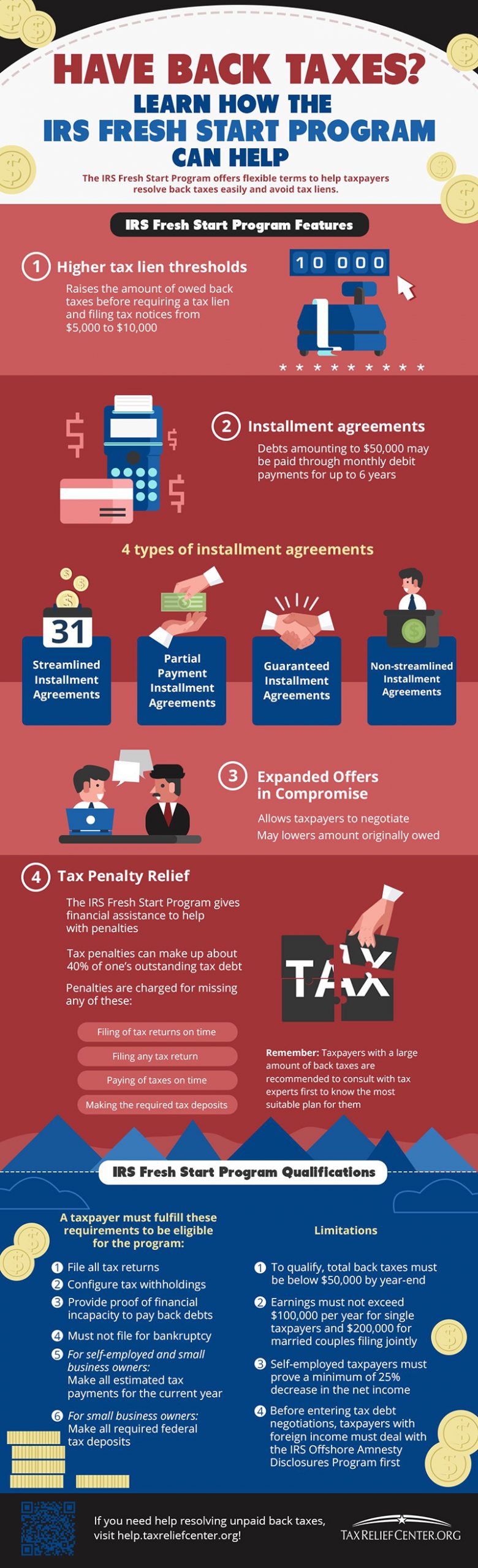

Believe it or not, there are new laws that have gone into effect to help financially strapped taxpayers today. The IRS announced their “Fresh Start Initiative” which allows more taxpayers than ever before to settle up with the agency. Now is the time to take advantage of these less-stringent, more flexible programs before the IRS changes its mind again. Don’t be embarrassed.

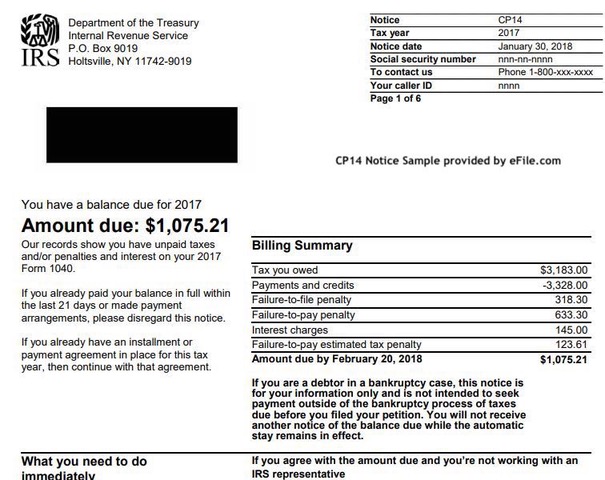

Don’t Ignore IRS Letters!

The IRS normally sends correspondence in the mail. They mail millions of letters to taxpayers every year. Keep these important points in mind if you get a letter or notice:

- Don’t Ignore It. You can respond to most IRS notices quickly and easily.

- Follow Instructions. Read the notice carefully. It will tell you if you need to take any action. Be sure to follow the instructions. The letter will also have contact information if you have questions.

- Focus on the issue. IRS notices usually deal with a specific issue about your tax return or tax account. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue.

- Correction Notice. If the IRS corrected your tax return, you should review the information provided and compare it to your tax return.

If you agree, you don’t need to reply unless a payment is due. If you don’t agree, it’s important that you respond. Follow the instructions on the notice for the best way to respond to us. You may be able to call to resolve the issue. Have a copy of your tax return and the notice with you when you call. If you choose to write, be sure to include information and any document you want them to consider. Also, write your taxpayer identification number (Social Security number, employer identification number or individual taxpayer identification number) on each page of the letter you send. Mail your reply to the address shown on the notice. Allow at least 30 days for a response.

In addition, if you file a return but don’t pay all tax shown as due on time, you will generally have to pay a late payment penalty. The Failure To Pay Penalty is one-half of one percent for each month, or part of a month, up to a maximum of 25% of the amount of tax that remains as unpaid from the due date of the return until paid in full. The one-half of one percent rate increases to one percent if the tax remains unpaid 10 days after the IRS issues a notice of intent to levy property. If you file your return by its due date and request an installment agreement, the one-half of one percent rate decreases to one-quarter of one percent for any month in which an installment agreement is in effect. Be aware that the IRS applies payments to the tax first, then any penalty amount charged each month.

If you owe tax and don’t file on time, there is a penalty for not filing on time. The Failure To File Penalty is usually five percent of the tax owed for each month, or part of a month that your return is late, up to a maximum of 25%. If your return is over 60 days late, there is also a minimum penalty for late filing; it is the lesser of $205 or 100 percent of the tax owed unless your failure to file was due to reasonable cause and not willful neglect.

The IRS may abate penalties for filing and paying late if you have reasonable cause and the failure was not due to willful neglect. Making a late payment as soon as you are able may help to establish that your initial failure to pay timely was due to reasonable cause and not willful neglect.

Don’t ever ignore the IRS. A timely response to any notices may keep open the various options that are available to resolve your matter. Finally, if you don’t know what to do are just intimidated by the IRS, contact a professional that specializes in IRS Tax Resolution. Remember, for every tax problem, there’s a solution.

Constant W. Watson III has more than 30 years of income tax and accounting experience.Watson is one of only twenty Certified Tax Resolution Specialists in the State of Illinois certified by the American Society of Tax Problem Solvers. He is also a CPA and a member of the American Institute of Certified Public Accountants.

Constant W. Watson III has more than 30 years of income tax and accounting experience.Watson is one of only twenty Certified Tax Resolution Specialists in the State of Illinois certified by the American Society of Tax Problem Solvers. He is also a CPA and a member of the American Institute of Certified Public Accountants.

Watson wants his clients to remember, “For Every Tax Problem There Is A Solution”.

You can hear his radio program “Watson On Taxes,” every Saturday morning at 10 a.m. by tuning in to AM 1390. For more information, visit Watson On Taxes @ https://www.constantwatsoncpa.com or call (708) 206-9900.