Cook County Treasurer Maria Pappas manages a $18 billion operation. She’s a hard worker and her employees respect and fear her. She says it can’t be done any other way.

Pappas recognizes employees who work hard and never take lunch. She knows that that person is going way above and beyond what she asks of them. Her name’s on the door. If she’s working hard, you’re working hard.

Pappas grew up in a small suburb of Wheeling, West Virginia, in an extraordinarily religious environment. She attended church seven days a week, and even taught herself how to play the pipe organ. The first thing she does when she gets up in the morning is say her prayers. Nothing long and drawn out, she simply prays: “”God, get me through this day. If there’s anybody that you need me to help or guide along the way, send them to me. I’ll talk to you later.”

Being in this business, Pappas has been around some of the wealthiest people in the world – people who own billion-dollar yachts. But she has kept her head on straight because she’s held on to her Wheeling, West Virginia roots. She keeps herself busy and recently downloaded the New York Times Magazine cooking app, after taking three courses at the French Pastry School.

Pappas has launched an initiative to help taxpayer san property owners who have been economically impacted negatively by the Coronavirus COVID-19 pandemic. N’DIGO sat down with her to discuss the Treasurer’s office extension tax plans to help property owners affected by the coronavirus and are unable to pay their taxes.

N’DIGO: You have changed the “law” regarding delinquent Cook County Property Taxes; why?

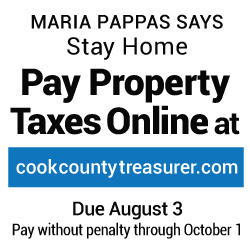

Maria Pappas: To give people time to juggle their finances as the pandemic hit. Many homeowners were jobless and commercial property owners hurting because tenants couldn’t pay the rent. Meeting the August 3 due date was going to be hard for homes and businesses alike, so I asked the Cook County Board of Commissioners to waive, for two months, the 1.5 percent penalty for late payment. The Board agreed, which effectively makes the due date October 1, giving taxpayers two more months to pay the Second Installment property tax bill.

Things were so bad that my office could not conduct the Annual Tax Sale, which was set for May 8. We’d already been working on alerting people that their property was on the Tax Sale list and that they should pay delinquent taxes to avoid late payments or even loss of property. A disproportionate number of homes from the Black community are on the Tax Sale list county-wide, about two thirds of some 40,000 Property Index Numbers.

To find these owners, we have begun a Black Homes Matter program which I host on WVON 1690 AM (Mondays at 3:30 p.m.) to warn about the Tax Sale and answer callers’ questions about taxes and see if they qualify for $79 million in available refund money and $39 million in unclaimed exemptions. We were set up at Operation PUSH with the same mission: Find people who have money coming and get them off the Tax Sale list; it’s a travesty that 10,000 taxpayers owe less than $1,000. Because of the disruption, the Tax Sale won’t be held until I determine that the pandemic has abated.

What changes has your office made because of COVID-19?

We’ve devoted ourselves to shrinking the Tax Sale list. Earlier this year, the list was at 50,000 Property Index Numbers. Now it’s at 40,000 because we worked hard to find people so they could get off the list. In one week, I did 47 radio and television shows to warn about the Tax Sale. We’ve sent ward lists to aldermen so they can find delinquent owners, often seniors, and warn them about the Tax Sale. While we’ve cut the list, we’re still trying to find property owners who should clear unpaid bills to avoid their unpaid taxes being auctioned at the Tax Sale to tax buyers who will demand expensive paybacks.

Do you believe people will lose their property due to the changing economic environment?

I can’t know because every situation is different, but I hope that never happens. What I do know is that I can help the property owner with complete information at a difficult time. If the owner goes to my website, cookcountytreasurer.com, he or she can see everything there is to know about their home or business, including a 20-year payment history that includes refunds that may be due, as well as looking back four years for unclaimed exemptions.

What is the state of real estate at this time?

It’s difficult to say. We seem to have moved into a mode of fear about our economic health and our future. We’re moving through uncharted waters, and that includes real estate.

Is this a good time to buy or sell real estate?

The Treasurer never should advise people what to do with real property. As always, of course, there are good and bad deals out there for home buyers and home sellers. But the Treasurer can say that rising property taxes are a long-term problem, so much so that people are wondering whether their children will be able to afford to live in homes they leave them even if the mortgage is paid.

You have done a stellar job in coming into the community with Cook County property tax information; what was your motivation?

The richness of Cook County lies in its diversity. We speak 126 languages, and my website has information in all of them. The property tax system is complex; most people don’t understand assessments, tax rates, levies and so on. We’ve tried to create a bill that gives owners key information, and backed it up with information on the website. We’ve had about 20 million visitors to my website, 500,000 in foreign languages. Because community outreach is important, I’ve appointed Honorary Deputy Treasurers to every ethnic group in Cook County to answer questions about property tax bills and report back to my office about things we need to know.

What are the most significant changes your office has made during your tenure?

Making it paperless for the taxpayer. It is possible to stay home and pay a bill, see if you’re on the Tax Sale list, check for refunds and exemptions, examine the financial statements of the local governments that tax your property, know where your payment money is going, and more. We’re now serving people on iPhones and iPads. No paper there.

Why did you want a career in politics?

I’m from West Virginia, a small town where everybody knew everybody else. But few knew much about government. Coal was king and that was that. But I got curious about people who seemed to have societal power, who seemed to have standing apart from the rest of us. Those were the politicians. When I came to Chicago, I became a psychologist and a lawyer. I worked in a drug program in Altgeld Gardens and started going to court to help my clients with their cases. I went to court a lot. I taught family counseling in eight European countries and Israel and saw that different people were the same in caring for their families and worrying about how to navigate life.

My trips through Europe and County courts made me see that if I was really going to serve people, it would have to be in public service as an elected official. One thing led to another, and I ran to be a commissioner on the Cook County Board and won in 1990. Two terms were an eye-opener! You actually could get things done through government and politics if you studied. I studied. In 1998, I ran for Cook County Treasurer and won. Now I could have an impact. In my first years, I worked with African American ministers whose churches were on the Tax Sale list — churches are supposed to be exempt but may need guidance to avoid taxes. We got 326 Black churches off the list.

Will you run for higher office?

No one in politics says never to anything that might come up in the future. But I can honestly say that I love my job and have no plans or intentions to do anything but be the best Cook County treasurer ever.

What do you want the public to know about your office as we live in this moment of crisis?

It’s your office, not mine. Although I’m the Treasurer, I’m just the tenant. You’re the landlord and that is that, period!